NAF Accounting:

Monday – Friday: 8:00 AM – 5:00 PM

VAT:

Monday – Friday: 9:00 AM – 2:00 PM

CIV: 01280.70.8860

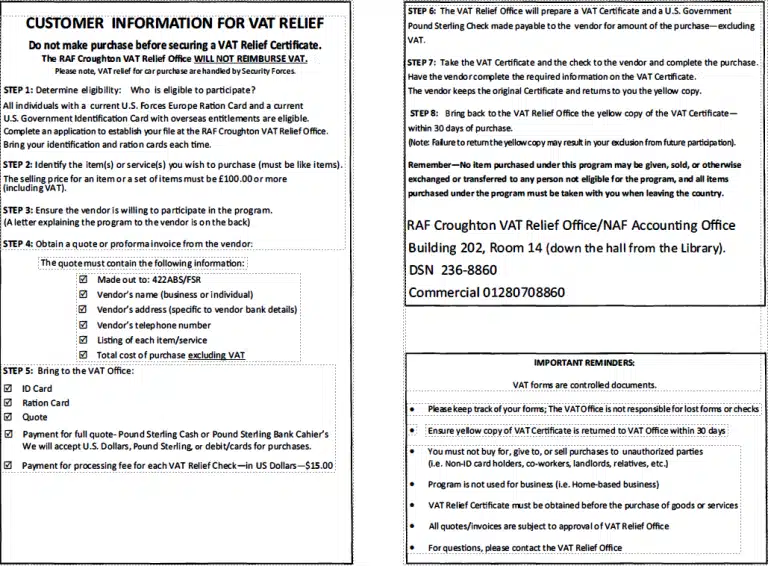

VAT Relief Exemption Program

VAT Relief is granted to US Visiting Force by Her Majesty’s Revenue and Customs (HMRC) and the process is determined by that office. Only US personnel issued a current Ration Card are eligible for VAT Relief.

VAT Relief Process

We can process VAT Relief checks within one day. Form of payment can now be paid through credit card, US dollars, or pounds sterling for the VAT Relief Program.

Each individual item or service must be processed at £100 or more to be eligible for VAT Relief. Items that cost less than £100 are not eligible, per HMRC. Utilities, real property, and vehicles are also not eligible for VAT Relief.

Please do not put down a deposit for items if you intend to use VAT Relief; doing so may nullify the transaction.